tax lien nj sales

CODs are filed to secure tax debt and to protect the interests of all taxpayers. Videos you watch may be added to the TVs watch history and influence TV recommendations.

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Anyone wishing to bid must register preceeding the tax sale.

. Tax sale liens are obtained through a bidding process. WHAT IS A TAX SALE. There is a 5 fee to provide you with a duplicate tax bill.

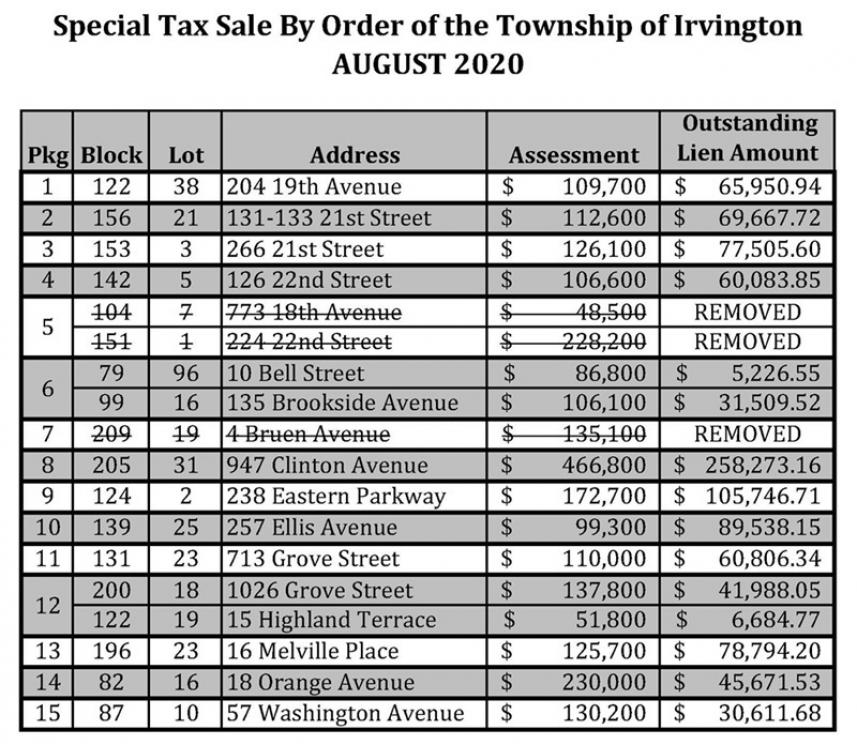

Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30. New Jersey is a very competitive tax sale state however and if there are any liens left over they are usually for junk properties. The City of Trenton announces the tax sale of 2019 2nd quarter and prior year delinquent taxes and other municipal charges through an online auction.

New Jersey is a good state for tax lien certificate sales. 2022 notice of sale for non-payment. A tax sale list will be published weekly in the echoes-sentinel for four weeks.

Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. A judgment entered in court that is available for public view. New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law.

Mondays - Thursdays 900 AM - 430 PM Fridays 800 AM -. Wildwood NJ currently has 1617 tax liens available as of April 11. If the lien is not redeemed within the 2-year redemption period the purchaser may start foreclosure on the property.

The tax sale can be held at any time after April 1st. Ad Find The Best Deals In Your Area Free Course Shows How. New Jersey Tax Lien Auctions.

If you choose to pay your taxes at City Hall please bring your whole entire bill with you. View dates for Tax Lien Sales. There is a 2 fee for all checks returned for insufficient funds.

We do not make copies of checks. Skip to Main Content. Its purpose is to give official notice that liens or judgments exist.

Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Loading Do Not Show Again Close. 4997 Unami Boulevard Mays Landing NJ 08330.

According to New Jersey law a property owner has Two 2 years to pay Hunterdon County the amount the winning bidder paid. The delinquencies will be subject to interest and charges as set forth by the state of New Jersey. Search Atlantic County inmate records through Vinelink by offender id or name.

973-697-8090 Municipal Building Hours. In addition New Jersey Tax Lien Certificates are secured by real estate. Municipal charges include but are not limited to.

Jail Phone 609645-5855 Fax 609909-7451. For additional information about NJ Tax Sales CLICK HERE. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Wildwood NJ at tax lien auctions or online distressed asset sales.

HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Here is a summary of information for tax sales in New Jersey. Tax Collectors Office Township of Teaneck 818 Teaneck Road Teaneck NJ 07666.

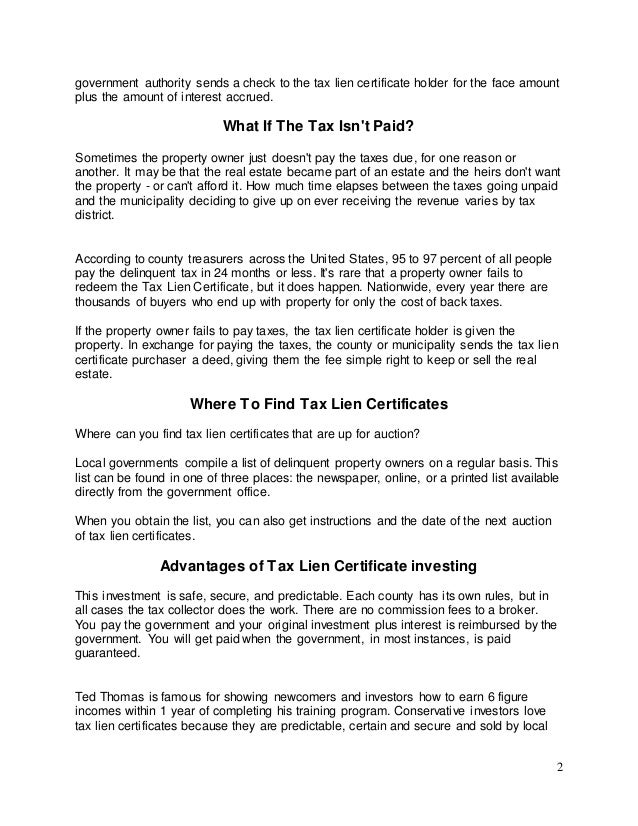

If playback doesnt begin shortly try restarting your device. According to state law New Jersey Tax Lien Certificates can earn as much as 18 per annum 4 - 6 on the amount winning bidders pay to purchase New Jersey Tax Lien Certificates. Atlantic County Sheriff and Jail.

In New Jersey county treasurers and tax collectors sell tax lien certificates to the winning bidder at the delinquent property tax sale. Any interested parties please send a self-addressed stamped envelope requesting for a tax sale list when it becomes available to. There are currently 4915 tax lien-related investment opportunities in Newark NJ including tax lien foreclosure properties that are either available for sale or worth pursuing.

Detailed listings of foreclosures short sales auction homes land bank properties. Added omitted assessments. A tax lien is filed against you with the Clerk of the New Jersey Superior Court.

Your canceled check is your receipt if you pay by check. At the sale a lien will be sold for the amount due with interest starting at 18 and going down as bid. Sheriff Jail and Sheriff Sales.

18 or more depending on penalties. Subsequent taxes paid by the lien holder earn interest at the rate set by the municipality. In New Jersey tax lien certificates are sold at each of the 566 municipal Tax Sales.

Investing in tax liens in Newark NJ is one of the least publicized but safest ways to make money in real estate. 1033 Weldon Road Lake Hopatcong NJ 07849 Phone. In fact the rate of return on.

Phone 609909-7200 Fax 609909-7292. Liens may also be sold or assigned to another investor. Tax delinquent properties are advertised in a local newspaper prior to the municipal tax sale.

Tax Sales - NJ Division of Local Government Services - DLGS httpwwwnjgovdcalgstaxescollectionelements_of_tax_sales_njshtml762011 12448 PM If the certificate is redeemed by the property owner prior to foreclosure the certificate earns a. For a listing of all parcels delinquencies and costs including registration and bidding instructions please visit the Tax Lien Auction site. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the.

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien Certificate Investment Basics

What Are Tax Lien Certificates How Do They Work

If You Wish To Invest In Tax Lien Properties The State Of New Jersey Conduct Online Tax Sales Bid Campaign New Jersey

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

Tax Liens An Overview Checkbook Ira Llc

Tax Sale Support 4 000 000 New Jersey Mansion With 50k Tax Lien Nj Tax Sale Review Facebook

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Tax Sale Lists Now Home Facebook

Tax Lien Investing Pros And Cons Youtube

How To Remove A Lien On Your Home New Home Buyer Us Real Estate Lets Do It

Beware Of The Accelerated Tax Sales In New Jersey Tax Lien Investing Tips Jersey New Jersey Jersey Girl

Profiting On Hud Properties Tax Lien Investing Investing Real Estate Investing Free Webinar

Tax Certificate And Tax Deed Sales Pinellas County Tax

Understanding Nj Tax Lien Foreclosure Westmarq

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube